Page 1

C.A. Reinstates Suit by Shuttered Eatery Against Insurer

Feuer’s Opinion Departs From Trend in Finding Potential Liability for Losses

Occasioned by Order to Close Down in Light of COVID-19 Pandemic

By a MetNews Staff Writer

Div. Seven of the Court of Appeal for this district, bucking the trend of decisional law, has held that a Ventura Boulevard Italian restaurant that shut down entirely during some periods, and restricted dining at other times to outdoor areas, in response to fluctuating government health orders during the COVID-19 crisis, has validly stated causes of action against its insurer based on its refusal to pay on claims under a business-loss policy.

The issue—resolved by the vast majority of decisions across the nation in favor of insurance companies—is whether a policy covering loss of income caused by “physical damage” to property can be invoked by businesses that were forced to cease or limit operations by virtue of orders issued in light of the pandemic.

Justice Gail Ruderman Feuer authored Wednesday’s unpublished opinion reversing Los Angeles Superior Court Judge Daniel J. Buckley’s June 16, 2021judgment of dismissal of an action against Century-National Insurance Company after the judge sustained demurrers without leave to amend, on June 2, 2021, based on prevailing decisional law.

In ordering reinstatement of the action by Shusha, Inc., which does business as La Cava—an eatery in Sherman Oaks—Div. Seven relied upon its own opinion in Marina Pacific Hotel and Suites, LLC v. Fireman’s Fund Insurance Company, rendered last July 13. There, it reversed Los Angeles Superior Court Judge Craig D. Karlan’s scuttling of an action by a hotel/restaurant against an insurer, saying that infestation of germs can be viewed as causing physical damage, as the plaintiff pled.

The policy provides:

“We will pay for the actual loss of Business Income you sustain due to the necessary ‘suspension’ of your ‘operations’ during the ‘period of restoration’. The ‘suspension’ must be caused by direct physical loss of or damage to property at premises….”

Feuer said:

“We agree La Cava’s allegations that contamination by the COVID-19 virus physically altered its restaurant premises were sufficient to withstand demurrer, and we reverse.”

|

|

|

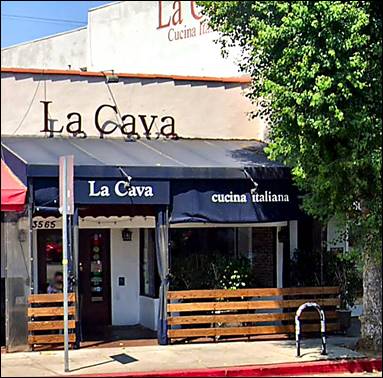

Depicted above is La Cava, an Italian restaurant in Sherman Oaks. The Court of Appeal for this district has held that the owners might be entitled to coverage under its business-loss insurance policy which applies where there is “physical damage” to the premises. The opinion says the restaurant’s owner has adequately pled that the virus caused such harm. |

Div. Four’s Opinion

Feuer’s opinion implicitedly rejects an effort by the Ninth U.S. Circuit Court of Appeals on Nov. 22 to restrict the opinion in Marina Pacific to the facts in the case and thus to reconcile it with one rendered by Div. Four of the Court of Appeal for this district on April 22.

Justice Audrey B. Collins authored Div. Four’s opinion in United Talent Agency v. Vigilant Insurance Co. She said in that opinion:

“[W]e agree with the majority of the cases finding that the presence or potential presence of the virus does not constitute direct physical damage or loss…..[T]he virus exists worldwide wherever infected people are present, it can be cleaned from surfaces through general disinfection measures, and transmission may be reduced or rendered less harmful through practices unrelated to the property, such as social distancing, vaccination, and the use of masks. Thus, the presence of the virus does not render a property useless or uninhabitable, even though it may affect how people interact with and within a particular space.”

Ninth Circuit’s Opinion

In its memorandum opinion in Tao Group Holdings, LLC v. Employers Insurance Company of Wausau, the Ninth Circuit rejected contentions of the insured, Tao, that its policy covered business losses at its restaurant and entertainment venues. Applying California law, the court recited:

“Under California law, loss of use of property does not constitute ‘direct physical loss of or damage to’ property….The California Court of Appeal held in United Talent Agency v. Vigilant Insurance Co…that ‘the presence...of the [COVID-19] virus does not constitute direct physical damage or loss’ to property.”

It continued:

“[T]the court in Marina focused on the allegation that the insured had disposed of property to get rid of COVID-19 contamination and that the insurance policy at issue expressly covered loss or damage resulting from communicable diseases….Tao has not alleged that it had to dispose of property damaged by COVID-19, nor did its policy contain an express provision covering loss or damage resulting from communicable diseases, so Tao did not allege facts sufficient to trigger coverage under California law. Nor has Tao argued that, if given leave to amend, it could add allegations like those in Marina.”

Reconciliation Rejected

Feuer did not mention the decision in Tao. She did, however make clear that the holding in Marina is irreconcilable with that in United Talent Agency.

She recounted that in Marina, “[w] e recognized the decision by our colleagues in Division Four of this district in United Talent Agency v. Vigilant Ins. Co….was not distinguishable in that it presented similar allegations to those at issue in Marina Pacific.”

The jurist went on to say:

“…Century-National argues Marina Pacific embodies a ‘narrow exception’ to the general rule that pandemic-related damages are not recoverable under business loss coverage, and it urges us instead to follow the skeptical approach taken by Division Four of this district in United Talent Agency….We see no reason to deviate from our decision in Marina Pacific, which did not carve out simply a ‘narrow exception,’ as suggested by Century-National.

Bad-Faith Claim

Cava has validly pled a cause of action for bad-faith refusal to settle, Feuer declared, explaining:

“Century-National does not challenge the sufficiency of the allegations it failed to conduct any investigation of La Cava’s claim; rather, it contends its denial was based on a disputed interpretation of the policy. But a genuine dispute foreclosing a bad faith claim exists only where the insurer’s position is maintained ‘in good faith and on reasonable grounds.’…At the pleadings stage, Century-National’s denial of coverage just three weeks after La Cava tendered its claim and in the earliest days of our understanding of the novel COVID-19 virus, cannot be deemed as a matter of law to have been made in good faith with reasonable grounds.”

She continued:

“Century-National treats Marina Pacific as a sea change in the law and characterizes its own position in April 2020 as clearly justified by the later endorsement of that position by numerous district courts. But at the time, it was settled law that environmental contamination that resulted in physical damage could trigger business income coverage….La Cava alleged COVID-19 was present and physically damaged its restaurant, and it alleged its insurance claim was not limited to civil authority coverage. And, as alleged, Century-National did not take any steps to determine whether COVID-19 caused physical damage to the La Cava premises before denying coverage.”

The case is Shusha v. Century-National Ins. Co., B313907.

Katheryn Lee Boyd and Kristen L. Nelson of the mid-Wilshire firm of Hecht Partners joined with New York lawyer Jonathan A. Sorkowitz in putting forth La Cava’s position. Spencer A. Schneider and Karen E. Adelman of the West Los Angeles firm of Berman Berman Berman Schneider & Lowary represented the insurer.

Copyright 2022, Metropolitan News Company