Wednesday, September 27, 2017

Page 1

Inventor Loses Bid in Ninth Circuit to Enjoin Collection of Back Taxes

However, Board of Equalization Has Pared the Sum Claimed From $55 Million to $1.9 Million Plus Interest;

Dispute Over Taxes Harks to 1993 and Has Included Two Trips to the U.S. Supreme Court

By a MetNews Staff Writer

|

|

|

—AP In this file photo, inventor Gilbert Hyatt poses for a photo at the Las Vegas offices of his accountant. The Ninth U.S. Court of Appeals held yesterday that the District Court properly dismissed his civil rights action aimed at enjoining California’s collection of taxes from him. |

Gilbert P. Hyatt, the inventor of integrated circuit technology whose 24-year battle with California over a disputed tax bill has twice gone to the United States Supreme Court, yesterday lost a battle in the Ninth U.S. Circuit Court of Appeals which affirmed the dismissal of his civil rights action against the state seeking injunctive relief.

Such relief was barred by the Tax Injunction Act, the opinion said, because Hyatt had “a plain, speedy and efficient remedy” under state law.

Not reflected in the opinion was that Hyatt on Aug. 29 prevailed after a 13-hour hearing before the Board of Equalization which, by a 3-2 vote, trimmed the state’s claim to taxes for 1991 and 1992 to $1.9 million, plus interest—a small percentage of what had previously been sought. The Ninth Circuit held oral argument in the case more than six months earlier, on Feb. 17.

State auditors in 1993 concluded that Hyatt’s move to Nevada was pretextual to avoid taxes. It was determined then that he owed $1.8 million for 1991; auditors in 1996 calculated a $5.6 million debt for 1992.

Amount Claimed Soars

With 3 percent interest compounded daily, the $7.4 million tax bill swelled to more than $55 million by the time he filed his action in the U.S. District Court for the Eastern District of California on April 4, 2014.

Hyatt contended that of the $101.8 million he earned in 1991 and 1992, only $600,000 was earned while he resided in California. The Board of Equalization was persuaded Aug. 29 that he did reside in Nevada in those years, but owed taxes for the time in 1991 when he still operated out of California.

With Hyatt’s tax debt resolved, there remained pending the appeal of Senior District Judge Garland E. Burrell Jr.’s dismissal on Feb. 9, 2015 of his action under 42 U.S.C. §1983 alleging violations of his violated his federal constitutional rights to due process and equal protection. The action sought to enjoin further investigations, administrative proceedings, and collection efforts.

Tax Injunction Act

The Ninth Circuit’s affirmance yesterday came in an opinion by Judge Julio M. Fuentes of the Third U.S. Circuit Court of Appeals, sitting by designation. He found that Hyatt’s action is barred by the Tax Injunction Act, 28 U.S.C. §1341, which provides:

|

|

|

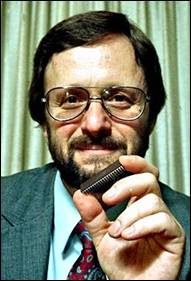

—AP Former Orange County inventor and entrepreneur Gilbert P. Hyatt, holding a microprocessor in a 1990 file photo, has been fighting with state officials for more than 24 years about his California income taxes. |

“The district court shall not enjoin, suspend or restrain the assessment, levy or collection of any tax under State law where a plain, speedy and efficient remedy may be had in the courts of such State.”

There is such a remedy, he declared. Fuentes pointed out that Hyatt has chosen to withhold payment pending the outcome of the administrative process—which a taxpayer may do based on an allegation of non-residency—but, under California law, that he could get into state court within six months if he would pay the taxes he is alleged to owe.

“In our view, the pay-then-protest remedy now provides Hyatt a speedy remedy, even if the protest-then-pay remedy has not,” he wrote.

The case is Hyatt v. Yee, No. 15-15296.

Michael von Loewenfeldt of Kerr & Wagstaffe LLP, one of the lawyers for the defendants, commented:

“We’re pleased by the Court’s ruling upholding the longstanding rule that California offers a plain, speedy, and efficient remedy to taxpayers through its pay-and-protest procedures.”

Numerous Battles

Hyatt, now 79, has been involved in battles throughout his adult life.

He battled for 20 years to gain a patent on a “single chip integrated circuit computer architecture”—that is, putting all of the processing power of a computer in a single chip. He was granted the patent in 1990.

However, the Patent and Trademark Office’s Board of Patent Appeals and Interferences later narrowed the patent, but only after he had received several millions of dollars in licensing fees. It was found that his 1970 application for a patent on the “single chip” did not meet formal requisites, and a rival 1973 application did.

The patent on other claims, including the invention of integrated circuit technology, remained standing.

In his first journey to the U.S. Supreme Court, he gained a 2003 affirmance of the Nevada Supreme Court’s decision that his action against the California Franchise Tax Board could proceed with respect to intentional torts, including invasion of privacy and fraud, based on its collection efforts. Then-Justice Sandra Day O’Connor wrote for the court in saying that the Full Faith and Credit Clause does not require Nevada to apply California’s governmental immunity statute.

A Nevada jury awarded Hyatt nearly $500 million. The Nevada Supreme Court whittled the judgment down to $1 million, for fraud, and ordered a new trial on recompense for intentional infliction of emotional distress.

On April 19, 2016, the U.S. Supreme Court, in an opinion by Justice Stephen Breyer, reversed. Nevada did not apply to California the same $50,000 lid on damages it that it would apply to Nevada’s own governmental entities.

Breyer said that “insofar as the Nevada Supreme Court has declined to apply California law in favor of a special rule of Nevada law that is hostile to its sister States, we find its decision unconstitutional.”

Hyatt has accumulated 70 patents.

Copyright 2017, Metropolitan News Company