Tuesday, July 19, 2016

Page 1

Ninth Circuit Upholds Dismissal of Suit by Wynn Resorts Shareholders

By KENNETH OFGANG, Staff Writer

|

|

|

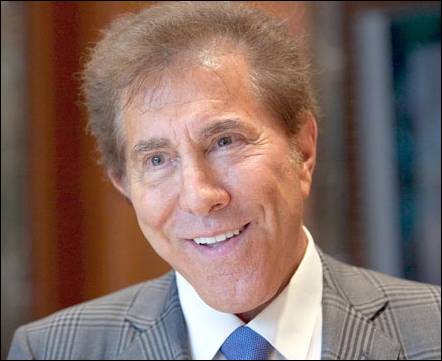

—AP In this file photo, Wynn Resorts CEO Steve Wynn speaks to the media during a press conference. |

Several shareholders of Wynn Resorts, Limited failed to show that they had a valid reason for not demanding the corporation sue several directors before launching their derivative action, the Ninth U.S. Circuit Court of Appeals ruled.

The judges affirmed an order dismissing the action under Rule 23.1 of the Federal Rules of Civil Procedure. The rule establishes heightened pleading requirements for derivative actions, including that of an explanation, “with particularity,” of the plaintiffs’ efforts to persuade the corporation to take the desired action or the reasons why such efforts were not made.

The plaintiffs claim Chairman/CEO Steve Wynn and other directors got a Macau casino project approved with a $135 million bribe masked as a university donation in 2011, and that a 2012 decision to redeem the shares held by Kazuo Okada, the only director to vote against the donation, was retaliatory.

Asking the board for action would have been futile, the plaintiffs alleged, because of board members’ conflicts of interest.

The donation was made to a foundation supporting the University of Macau, whose chancellor also headed the island’s government and held final say over approvals for the company’s requested expansion of its casino there, the plaintiffs allege.

Wynn Resorts opened its first hotel on the Chinese island in 2006, on land it had previously leased from the regional government, and applied for a second lease for a new resort and casino. The second lease was approved about a month after it made the donation.

No SEC Action

The plaintiff shareholders alleged the donation wasted assets and exposed the company to liability for a possible violation of the Foreign Corrupt Practices Act. The Securities and Exchange Commission looked into the donation but took no action.

Wynn, meanwhile, hired former FBI Director Louis Freeh to probe allegations that Okada gave improper gifts to gaming regulators in the Philippines. Freeh said Okada was “unsuitable” to own shares of a gaming company under Nevada law, leading to a $1.9 billion redemption of Okada’s $2.77 billion equity stake in the company.

Wynn and Okada, who Wynn reportedly once called his best friend, have been battling over the redemption in Nevada state court.

U.S. District Judge James Mahan of the District of Nevada dismissed the derivative action in February 2013, saying the plaintiffs failed to adequate plead their allegations that a majority of the board was “beholden” to Wynn.

Judge Diarmuid O’Scannlain, writing for the Ninth Circuit, said Mahan acted within his discretion.

Nevada Law

The judge explained that the question of whether a demand for action by the directors would have been futile must be determined under the law of the state of incorporation, which is Nevada.

Under that law, the plaintiffs had to show that at least half of the eight directors serving on the board at the time of the operative pleading lacked independence from the potential defendants in a suit over the alleged misconduct. Since it was conceded that Steve Wynn and his ex-wife Elaine Wynn were not independent, the plaintiffs had to show that at least two of the other six directors also lacked independence.

The plaintiffs argued that three of the directors—ex-Nevada Gov. Robert Miller, developer D. Boone Wayson, and investment banker J. Edward “Ted” Virtue—were too closely connected to Steve Wynn to be expected to act in the corporation’s best interests.

O’Scannlain, however, dismissed as immaterial the plaintiffs’ allegations that Miller was compromised by his 23-year friendship with Wynn, who was a major financial supporter of Miller’s political career, and that of his son, ex-Nevada Secretary of State Ross Miller. The donations to Robert Miller were too remote in time, and those to Ross Miller “too insubstantial,” to support a finding that the former governor would set aside the corporation’s interests in favor of Wynn’s, the judge said.

Nor, the jurist went on to say, did the plaintiffs state allegations that the relationship between Wynn and Wayson, whose fathers operated a bingo hall together in the 1950s, or between Wynn and Virtue, who worked at companies that provided Steve Wynn with financing for various ventures, was such as to compromise the directors’ independence.

Demand futility, the judge declared, cannot be found on the basis of “vague and impersonal business relationships,” particularly dated ones.

The case is Louisiana Municipal Police Employees’ Retirement System v. Wynn, 14-15695.

Copyright 2016, Metropolitan News Company